Global Glimpse: How Countries Shape Their Unique Regulations

Cryptocurrencies are weaving themselves into the fabric of our financial landscape, and like all valuable assets, they come with tax obligations.

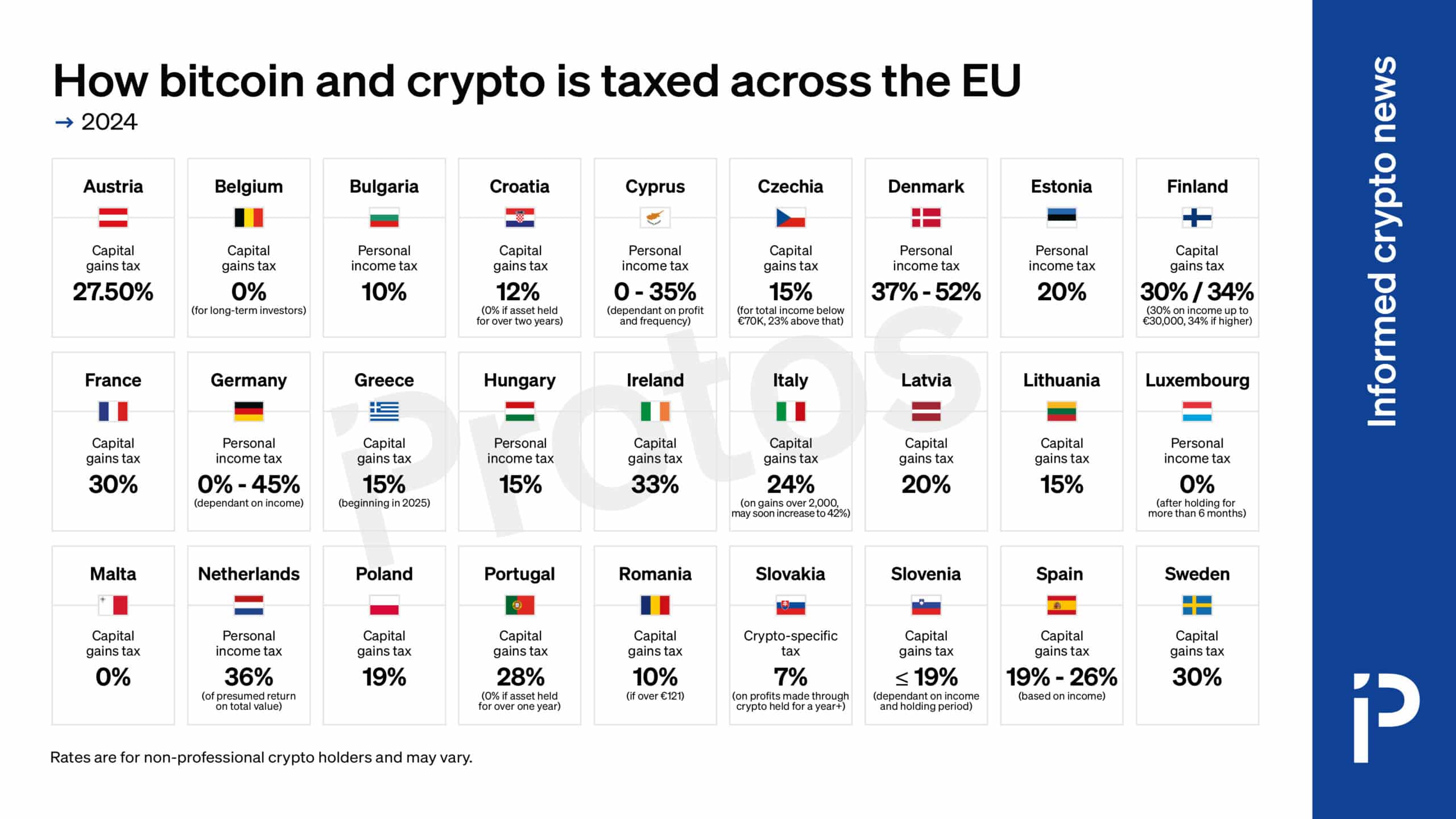

As an exciting and rapidly evolving asset class, cryptocurrencies are capturing the attention of investors and regulators alike. Countries around the globe are navigating the uncharted waters of cryptocurrency regulation and taxation with varying degrees of enthusiasm. So how do cryptocurrency tax policies stack up worldwide?

Which Countries Mandate Cryptocurrency Taxes?

In the United States, evading taxes is not an option—especially when it comes to digital assets. The IRS takes a stringent stance, categorizing cryptocurrencies as property, not currency. This means that if you sell your crypto, you’re liable for capital gains taxes, which can vary depending on whether you’ve held the asset for less than a year (short-term) or longer (long-term).

Across the pond in the UK, the scenario is similar—cryptocurrencies are taxed just like any other asset. The Capital Gains Tax (CGT) kicks in on earnings exceeding a tax threshold. If your crypto trading profits soar above a certain limit, expect to file a tax return.

In Australia, the Tax Office also classifies cryptocurrencies as assets, which means selling your tokens at a profit will incur capital gains tax. Yet, there’s a silver lining—if you’re using crypto to make purchases under $10,000, you might just dodge that tax bullet.

Europe is making strides, with Switzerland leading the charge. Some residents can even pay their taxes in cryptocurrency, as noted by the Federal Tax Administration (FTA):

“If salary or ancillary salary benefits are paid to employees in the form of payment tokens, these are taxable as income and must be shown on the salary certificate.”

Why Are Some Countries Tax-Free for Cryptocurrencies?

Several nations are rolling out the welcome mat for cryptocurrencies by waving goodbye to mandatory taxes. These countries are eager to attract investors and foster thriving crypto startups.

Take Portugal, for instance. Citizens here enjoy a rare exemption from taxes on income generated from cryptocurrency trading, with only specific professional use cases subject to taxation.

Germany also offers a tax incentive: if you hold your cryptocurrencies for over a year before selling, you’re on the tax-free train. However, cashing in before that one-year mark means capital gains tax applies.

Meanwhile, Malta is actively nurturing its crypto sector, levying taxes only on sales or exchanges involving fiat currency—otherwise, it’s tax-free!

Conversely, some countries don’t impose cryptocurrency taxes simply because they’ve outlawed digital currencies altogether.

Countries That Have Banned Cryptocurrencies

China is a notable name in the crypto ban league, having prohibited all transactions involving digital currencies since 2021, including a widespread crackdown on mining—causing massive disruptions for investors and crypto firms operating within its borders.

Algeria follows suit, with a complete ban on cryptocurrency activities, from trading to mining. The government prohibits any cryptocurrency transactions, effectively sealing its digital currency fate.

Other countries in MENA and Asia, such as Morocco, Pakistan, and Indonesia, also prohibit cryptocurrencies, leaving investors high and dry.

Why Are There No Cryptocurrency Taxes in Some Countries?

Beyond bans and the allure of attracting investment, many nations lack cryptocurrency tax policies simply because they haven’t yet established regulations for these digital assets.

Japan, for instance, has acknowledged Bitcoin (BTC) and other cryptocurrencies as legal tender, yet the regulatory framework remains under construction. While there are rules governing crypto exchanges, significant gaps exist regarding how these assets are taxed.

Similarly, in Nepal, cryptocurrencies exist in a murky legal landscape; the government has yet to develop appropriate legislation, leaving them in a gray area.

What’s on the Horizon for Cryptocurrency Taxation?

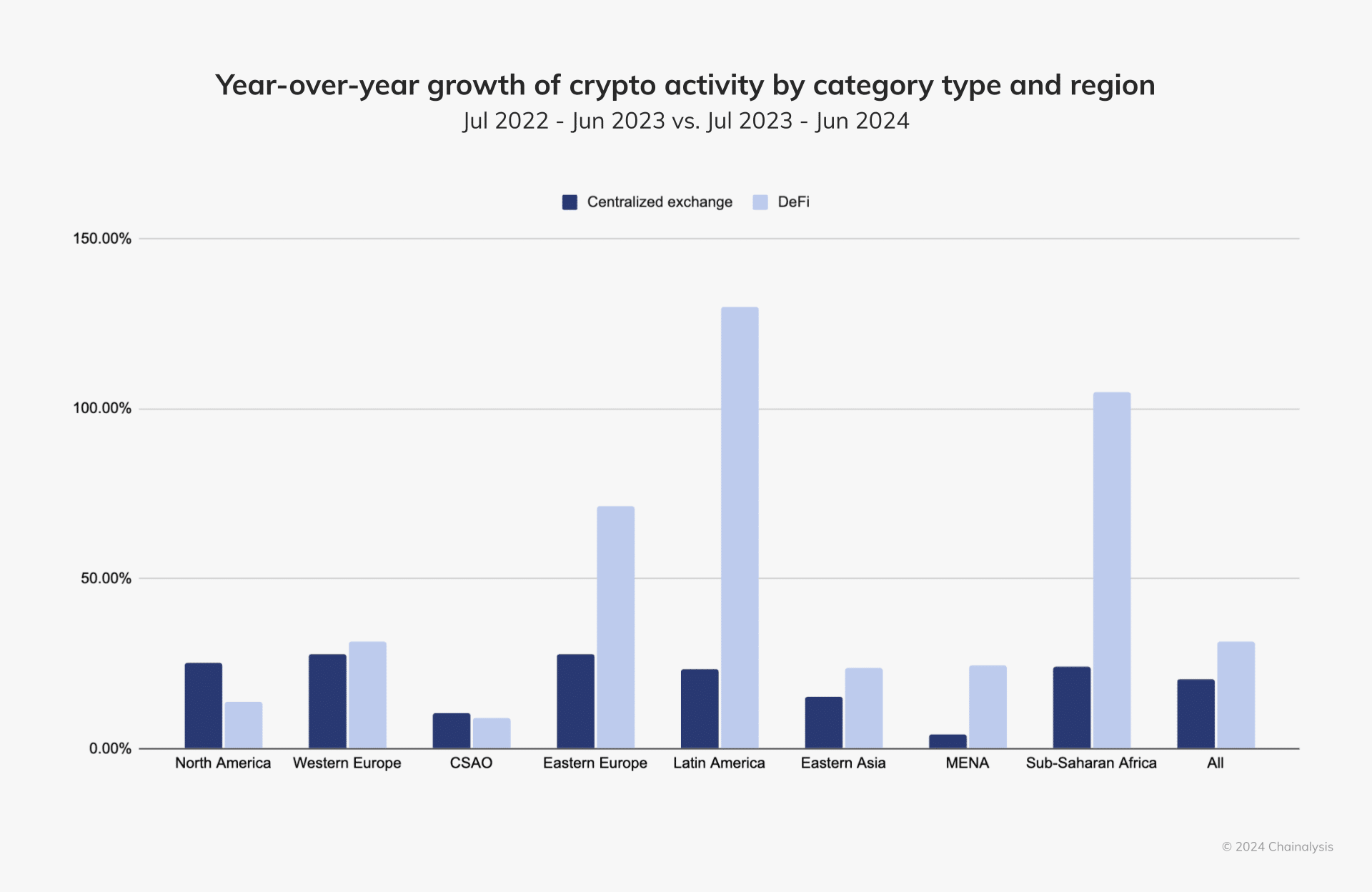

The taxation of cryptocurrencies varies dramatically across the globe, resulting in diverse approaches to regulation. While some countries are diligently crafting tax policies for these digital assets, others remain mired in uncertainty, and some have outright bans. Yet, as reported by Chainalysis, cryptocurrency adoption is on the rise worldwide.

As the landscape of cryptocurrency taxation continues to evolve, we can expect greater clarity and regulation to emerge, offering stability for investors and market players. However, the pace of change will likely fluctuate depending on regional and political dynamics.