LA’s 2024 Real Estate Crisis: Shocking Surge in Mortgage Defaults!

The commercial landscape in Southern California is shifting dramatically, with high-profile defaults casting a shadow over once-thriving hubs like Santa Monica Place and Silicon Beach. As the clock ticks down to 2024, commercial borrowers are feeling the heat as their loans come due.

In a startling revelation, landlords in Los Angeles and Orange counties are bracing for a daunting $21 billion worth of commercial mortgage-backed security loans and collateralized loan obligations that are set to mature this year. Alarmingly, over half of these loans were already under scrutiny at the beginning of the year, teetering on the brink of default.

Recent reports reveal that more than one in ten CMBS loans tied to office properties nationwide found themselves in delinquency by the end of 2024—a trend that Southern California is not immune to.

Beyond the office sector, other commercial property owners are grappling with their own financial troubles. Take, for example, Edward J. Minskoff Equities, which faced significant losses after selling its 500,000-square-foot Playa Vista office complex—known as The Bluffs—for a fraction of its original value.

But it’s not just office spaces facing turmoil. The year has seen a surge in loan defaults across various sectors in Los Angeles County, with retail and multifamily properties among the hardest hit. Below, we delve into some of the most notable defaults of the year, each with a staggering debt threshold of at least $200 million.

Santa Monica Place | Macerich | $300 million

In April, mall owner Macerich made the difficult decision to relinquish its 527,000-square-foot outdoor shopping center, Santa Monica Place, after defaulting on a $300 million loan that was nearing maturity. Once a bustling shopping destination across from the Santa Monica Pier, occupancy plummeted from 95% pre-pandemic to just 81% in 2022.

Despite securing an extension to avoid immediate default the previous year, Macerich faced another setback in April when the loan was transferred back to special servicing. With occupancy rates dipping to 69% this year, the company ultimately chose to walk away from its flagship property.

“Ultimately, trying to figure out the end game was just too obscure,” commented Scott Kingsmore, Macerich’s CFO.

The Bluffs | Edward J. Minskoff Equities | $271 million

In May, Edward J. Minskoff Equities received a default notice from Morgan Stanley regarding a $250 million loan tied to The Bluffs, which came due with an alarming $271 million unpaid balance. By October, the office complex was sold to Lincoln Property and Strategic Value Partners for just $187.5 million, a stark contrast to the $413 million Minskoff initially paid for it in 2016.

The departure of major tenant Fox Interactive Media in 2021 left the property struggling to fill its expansive spaces, compounded by tech giants downsizing in the wake of the pandemic.

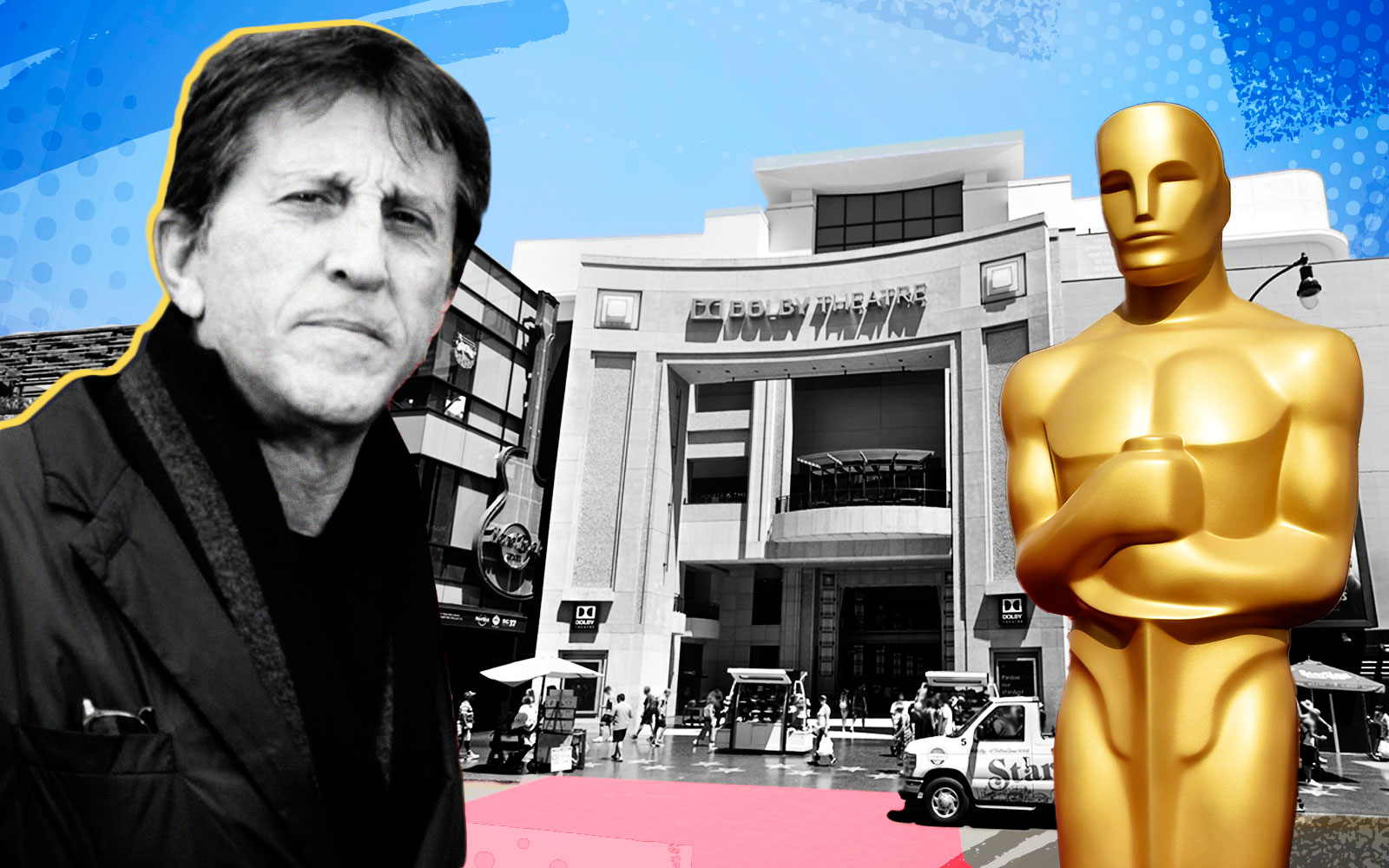

Ovation Hollywood | Hollywood | $211 million

In a troubling indicator for Hollywood’s entertainment district, a $211.3 million loan associated with Ovation Hollywood defaulted in August. This shopping center, formerly known as Hollywood & Highland, was built in 2001 and is currently 75% occupied.

Originally taken out by Gaw Capital in 2019, the loan was placed on a special servicing watchlist a few months before defaulting, signaling deteriorating market conditions. The iconic Dolby Theatre, where the Oscars are held, has seen its ownership change hands, with producer Elie Samaha purchasing it for $50 million in a significant discount deal in September.

Mandarin Oriental Residences | Shvo & Deutsche Finance | $200 million

In another blow to luxury real estate, Michael Shvo and his partners faced financial difficulties at the Mandarin Oriental Residences in Beverly Hills. Despite selling ten luxury condos at an average price of $3,200 per square foot, the project fell victim to a default notice in September after failing to repay a $200 million loan.

The 54-unit complex at 9200 Wilshire Boulevard has now been put up for bulk sale, as the owners seek to recoup losses and navigate the difficult waters of a changing market.

:max_bytes(150000):strip_icc()/sq6gg-30-year-refinance-rates-by-state-dec-31-2024-1d717447180142d7a4b9c811eef0e0e6.png?w=390&resize=390,220&ssl=1)