Unlocking Your 2024 Property Tax Statement: A Simple Guide to Savings!

Unlock Your Savings: Discounts and Payment Options

Ready to take charge of your property taxes? Make your payments on time to score exclusive discounts! Don’t miss out—late payments could cost you more, including interest fees.

Option 1: Pay the full amount by November 15, 2024 and snag a sweet 3% discount!

Option 2: Pay two-thirds by November 15, 2024 for a 2% discount, and handle the remaining third by May 15, 2025.

Option 3: Split your payments! Pay one-third by November 15, 2024, another third by February 18, 2025, and the final third by May 15, 2025.

Go Green: Paperless Property Tax Statements Are Here!

Say goodbye to paper clutter! Clackamas County now offers electronic delivery of property tax statements through eNoticesOnline. If you’re ready to embrace the digital age and receive your documents straight to your inbox, you can sign up with the unique registration code found on your tax statement. Once you’re registered, you’ll only receive electronic notices—no more paper!

Have Questions? Property Value Appeals Board (PVAB) Is Here to Help!

Not satisfied with the values on your tax statement? Don’t hesitate—give us a call at 503-655-8671. Our knowledgeable appraisal team is eager to assist you!

If you still disagree with the assessed values, file an appeal with the Property Value Appeals Board (formerly BOPTA) by Tuesday, December 31, 2024.

Need more info? The County Clerk’s office is just a call away at 503-655-8662.

Find appeal forms online. Remember, to ensure your appeal is considered, it must be postmarked or delivered to the Clerk’s office by December 31, 2024.

Join the Conversation: Virtual Town Hall!

Mark your calendars! Join Assessor Bronson Rueda for an engaging virtual Town Hall on Wednesday, November 6, from 6 p.m. to 8 p.m. Be part of the discussion!

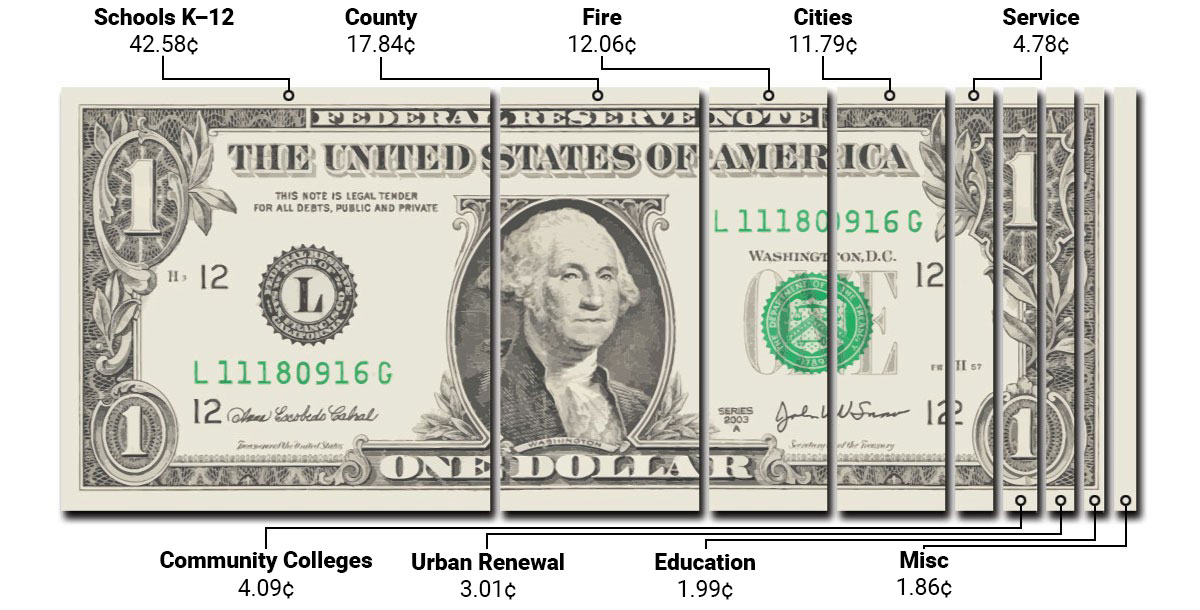

Your Property Taxes: Supporting Local Services That Matter!

Did you know your property taxes are the backbone of local services in Clackamas County? They support 131 local government taxing districts, including 18 school districts, 16 cities, and 13 fire districts, plus many more essential services like water, public safety, and more.

1 Based on data from 2023

2 Services include Library, Metro, Extension Office, and Sewer.

3 Miscellaneous includes Port, Vector, Cemetery, Water, Parks, and Lighting.

Stay Informed: Values and Updates!

The Real Market Value (RMV) in Clackamas County has stayed fairly steady, with some areas seeing minor fluctuations as of the January 1, 2024 assessment date. Low inventory and quick sales continue to shape the residential market.

Remember, your property taxes are based on Assessed Value (AV), determined by the lesser of RMV or Maximum Assessed Value (MAV). Under Measure 50, MAV usually grows by 3% annually, leading to a common tax increase of 3% for many property owners this year, although individual situations may vary.

Watch out: Tax increases beyond 3% could occur due to property changes like renovations, new constructions, or new voter-approved measures.

For more details on property taxes, please visit our website.

Yellow or Green Statement—What’s the Difference?

A yellow tax statement means that your mortgage lender has requested your payment information and may be handling your property tax payments. If you have questions, just reach out to your lender. Keep your statement handy for your records, and remember: if your lender is covering your taxes, don’t make a payment!

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIGL6YW7MNGQJAXYOOM36JKVK4.png?w=220&resize=220,150&ssl=1)