Why Michigan Ranks 14th for Property Taxes: What You Need to Know!

The journey of homeownership in America has been nothing short of a rollercoaster over the past few years. With demand soaring and inventory dwindling, buyers are caught in an intense battle, driving home prices to unprecedented heights. And if that wasn’t enough, sky-high interest rates have thrown a wrench into the plans of many hopeful homeowners, making the dream of owning a home feel increasingly out of reach.

While seasoned homeowners have enjoyed the silver lining of rising home values—thanks to equity gains—they too find themselves navigating a tricky landscape. Many are essentially “locked in” to their current properties, having secured low-interest mortgages before rates began their steep climb. The dilemma? If they decide to relocate, they’re faced with the tough choice between downsizing to more affordable digs or grappling with substantially higher monthly payments on a new mortgage.

And let’s not forget about property taxes. These taxes, generally calculated as a percentage of a home’s assessed value, have become an increasingly heavy burden. With property values skyrocketing since 2020, many homeowners are confronting tax bills that have risen significantly, further squeezing their budgets—whether they hold a fixed-rate mortgage or own their homes outright.

To soften this blow, some states have stepped up with protective measures against steep tax hikes. Come 2024, 19 states—including California, Florida, and New York—will enforce caps on annual assessments, shielding homeowners from the full brunt of escalating home prices. Yet, while these measures provide some relief, they inadvertently create a paradox: longtime owners are less inclined to move, resulting in stark disparities in property tax burdens across the nation.

The Critical Role of Property Taxes

Property taxes represent the largest slice of state and local tax revenue

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

While higher property taxes can feel like an insurmountable challenge for many homeowners, they serve as a crucial lifeline for state and local governments. These taxes are fundamental to financing vital services such as education, public safety, and infrastructure. Unlike other tax types, property taxes tend to provide a more stable revenue stream, less susceptible to the ups and downs of the economy.

From 2019 to 2023, property tax revenue surged, marking the most significant increase among major tax categories—up by a staggering $165 billion (27%) from $617 billion to $782 billion. This increase outpaced sales tax revenue and individual income tax growth, highlighting the essential nature of property taxes in supporting local economies.

Shifts in Property Tax Rates

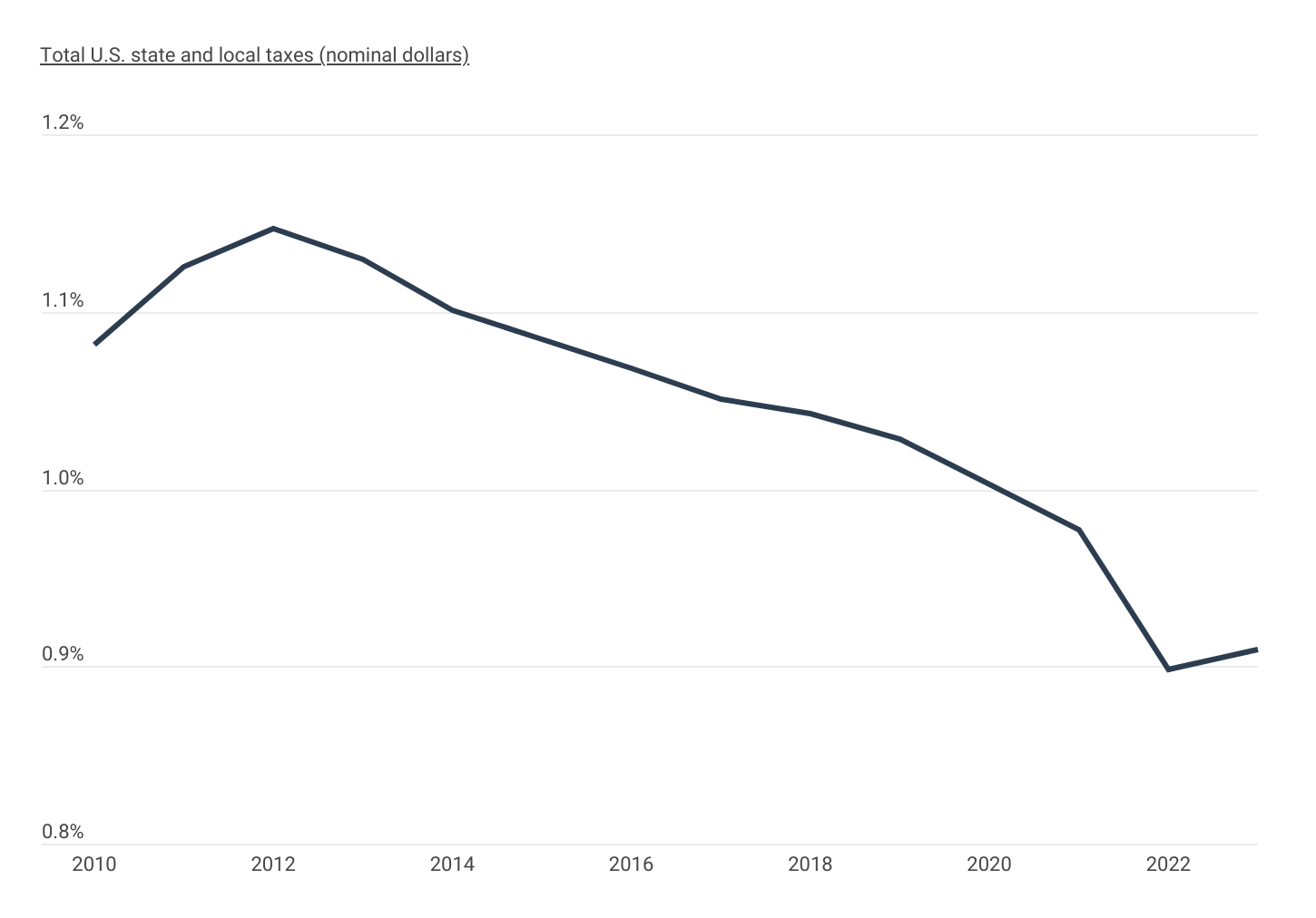

Property tax revenues have struggled to keep pace with rapid growth in home prices

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

Homeowners might expect that the recent surge in home values would lead to a proportional increase in property tax bills. However, the reality paints a more nuanced picture. Nationwide, the effective property tax rate—the total taxes paid as a percentage of the aggregate value of owner-occupied homes—has been on a downward trend over the last decade. It peaked at 1.147% in 2012 and dipped to a record low of 0.898% in 2022. While a slight uptick to 0.909% is noted for 2023, this rate remains significantly below its historical peak.

This disparity arises from the lag in property tax assessments, which are typically updated at intervals or when ownership of a home changes. This disconnect means long-term homeowners may benefit from lower effective rates, while newcomers purchasing homes at current market values often face higher tax bills—creating an uneven playing field.

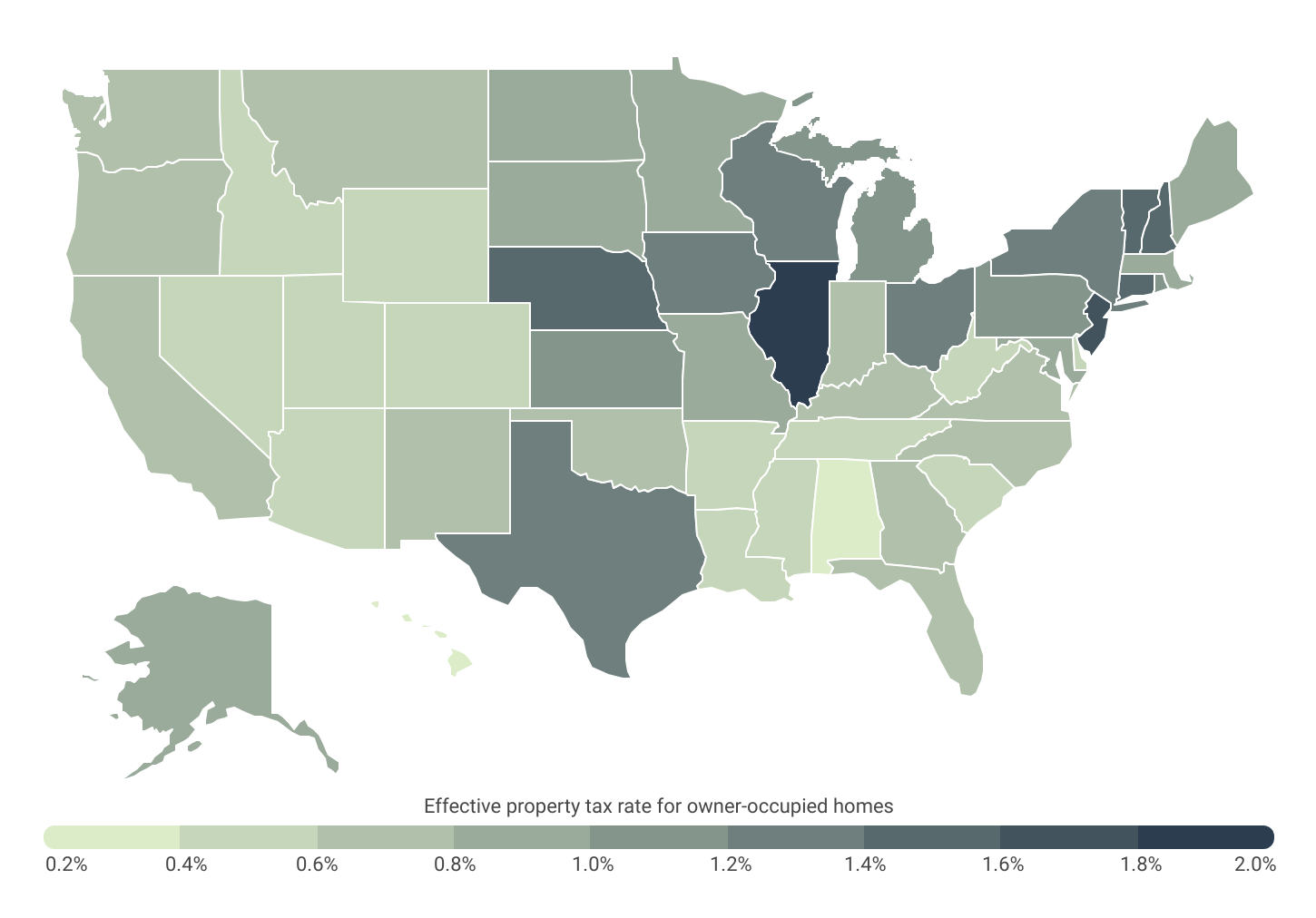

Geographic Variations in Property Taxes

Illinois and New Jersey lead the pack with the highest effective property tax rates for owner-occupied homes

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

In the landscape of American property taxes, there’s a striking variability depending on the state, county, and city—an intricate web of local tax regulations that results in significant disparities. The Northeast and Midwest regions typically bear the brunt of the highest effective property tax rates for owner-occupied homes, with Illinois leading at 1.825% and New Jersey close behind at 1.773%. Other states like Connecticut, Nebraska, and Vermont also feature prominently, often due to higher service and infrastructure needs in these more densely populated areas.

Conversely, the South and Mountain West regions generally enjoy lower effective rates, with Hawaii (0.318%) and Alabama (0.359%) at the bottom of the list. Texas, notable for its unique tax structure, ranks seventh, with an effective property tax rate of 1.356%.

When examining county-level data, the gaps become even more pronounced. Salem County, NJ, tops the charts with the highest effective tax rate at 2.382%, followed closely by Monroe County, NY, at 2.314%. On the flip side, DeKalb County, AL, boasts the lowest rate at a mere 0.157%.

City-level variations echo these patterns. Trenton, NJ, is home to the highest effective property tax rate of any U.S. city at 2.653%, while Montgomery, AL, enjoys the lowest at just 0.277%. The leading cities for high tax rates are once again found in Illinois, New Jersey, and Connecticut, whereas those with the lightest burdens are predominantly located in Alabama, Louisiana, and Hawaii.

Here’s a snapshot of Michigan’s property tax landscape:

- Effective property tax rate for owner-occupied homes: 1.148%

- Median property taxes paid for owner-occupied homes: $2,845

- Median owner-occupied home value: $236,100

- Median owner-occupied household income: $82,155

And for a broader context, here are the statistics for the entire United States:

- Effective property tax rate for owner-occupied homes: 0.909%

- Median property taxes paid for owner-occupied homes: $3,057

- Median owner-occupied home value: $340,200

- Median owner-occupied household income: $95,915

For a more in-depth look, including detailed methodology and complete results, explore the analysis on property tax variations across states, counties, and cities.